Discover Referral $100 Review: Get your Bonus with Referral Link

In this objective Discover Referral $100 review, we’ll provide an unbiased analysis of the card’s features and benefits, focusing on receiving a $100 bonus by applying for the Discover it Cash Back card using our exclusive referral link.

The Discover it credit card is an excellent choice for those seeking a rewarding and feature-packed credit card. With its generous cashback program, introductory APR offers, and no annual fee, the Discover it card provides substantial value to cardholders. Plus, for a limited time, new applicants can earn a $100 bonus by applying through our unique referral link.

To qualify for the $100 referral bonus, simply click on the referral link provided in this article and complete the application process. If approved, you’ll receive your Discover it card in the mail and can start earning cashback rewards on your purchases right away. Meet the requirements for the bonus, such as making a purchase within the first three months, and the $100 bonus will be credited to your account.

In the following sections, we’ll delve into the benefits of the Discover it card, provide a step-by-step guide on how to earn the $100 bonus, and share tips for maximizing your rewards. Whether you’re looking for a new credit card or want to take advantage of this exciting bonus offer, the Discover it card is an option worth considering.

Discover Referral Program: Why the $100 Bonus Is Worth Considering

The Discover it credit card offers a range of benefits that make it an attractive option for many consumers. With its cash back rewards, introductory APR offers, and no annual fee, the card provides substantial value to cardholders. Let’s take a closer look at some of the key features and advantages of the Discover it card.

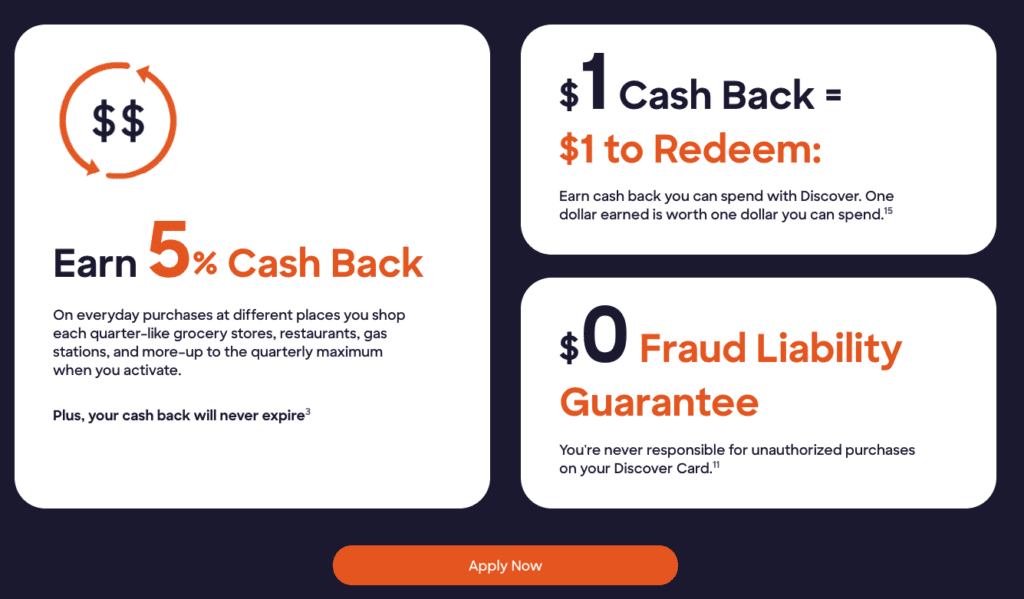

Cashback Rewards Structure

The Discover it card offers a competitive cash back rewards program, which includes Cardholders can earn 5% cashback on rotating categories each quarter, up to a quarterly maximum (typically $1,500 in purchases). These categories often include popular spending areas such as grocery stores, gas stations, restaurants, and online shopping. All other purchases earn 1% cashback, with no limit on the amount you can earn.

Intro APR Offers and No Annual Fee

The Discover it card offers an introductory 0% APR on both purchases and balance transfers for the first 14 months. This can be a significant benefit for those looking to finance a large purchase or transfer a balance from a high-interest credit card. After the intro period, the APR will vary based on your creditworthiness. Additionally, the Discover it card has no annual fee, making it a cost-effective option for long-term use.

Additional Perks and Benefits

In addition to its rewards program and intro APR offers, the Discover it card provides a range of other benefits, including:

- Free FICO credit score access

- No foreign transaction fees

- 24/7 customer service

- Fraud protection and alerts

- Cashback match at the end of your first year

These additional perks and benefits add to the overall value of the Discover it card, making it a well-rounded choice for many consumers.

Step-by-Step Guide: How to Get Your $100 Referral Bonus from Discover

Earning the $100 referral bonus with the Discover it credit card is a simple process. By following these steps, you can quickly apply for the card and meet the requirements to receive your bonus.

Click on the Provided Referral Link to Apply for the Card

To begin the application process and ensure you’re eligible for the $100 referral bonus, click on the unique referral link provided in this article. This link will direct you to the official Discover it credit card application page, where you can enter your personal and financial information.

Fill Out the Application Form and Submit It for Approval

Once you’ve clicked on the referral link, you’ll need to complete the Discover it credit card application form. This form will ask for details such as your name, address, income, and employment information. Be sure to provide accurate and up-to-date information to increase your chances of approval. After you’ve filled out the form, submit it for review and await Discover’s decision.

Meet the Requirements for the Bonus

To qualify for the Discover’s generous $100 referral bonus, you’ll need to meet certain requirements after your application is approved. Typically, this involves making a minimum amount of purchases within the first three months of card membership. For example, you may need to make at least $500 in purchases within the first 90 days to receive the bonus.

Once you’ve met the bonus requirements, the $100 will be credited to your Discover it account within a specified timeframe, usually 1-2 billing cycles. You can then use this bonus to offset your purchases or redeem it for other rewards, such as gift cards or charitable donations.

Who Qualifies for the Discover it Card and the $100 Referral Bonus?

Before applying for the Discover it credit card, it’s essential to understand the eligibility requirements. While Discover considers various factors when reviewing applications, there are some key criteria that can impact your chances of approval.

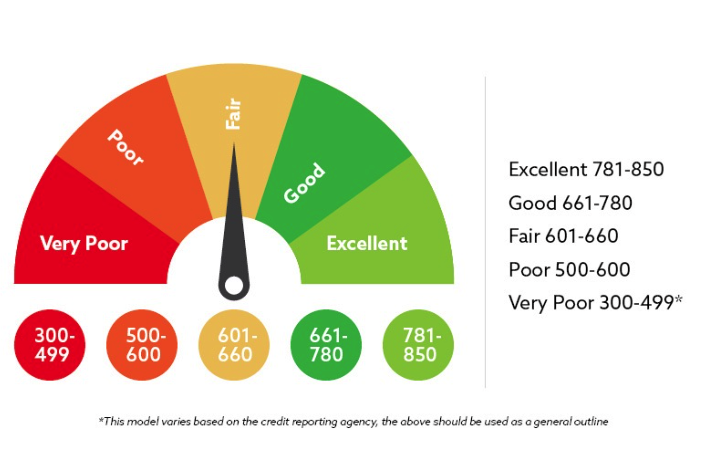

Credit Score Requirements

One of the most important factors in determining your eligibility for the Discover it card is your credit score. Generally, a good to excellent credit score is recommended for approval. This typically means a FICO score of 670 or higher. However, keep in mind that credit score alone does not guarantee approval, as Discover will consider other factors as well.

Income and Employment Information

In addition to your credit score, Discover will review your income and employment information when considering your application. A stable income and employment history can demonstrate your ability to make payments on time and manage credit responsibly. Be prepared to provide details about your current employment, income, and other financial obligations when filling out the application form.

Other Factors That May Impact Eligibility

While credit score, income, and employment are significant factors in determining eligibility, Discover may also consider other elements of your financial profile, such as:

- Credit utilization ratio

- Payment history

- Length of credit history

- Recent credit inquiries

- Debt-to-income ratio

By maintaining a low credit utilization ratio, making payments on time, and having a mix of credit types in your history, you can improve your chances of approval for the Discover it card. Additionally, minimizing recent credit inquiries and keeping your debt-to-income ratio low can demonstrate responsible credit management.

Insider Tips to Boost Your Chances of Approval for the Discover it Card

To increase your chances of being approved for the Discover it credit card and earning the $100 referral bonus, consider the following tips when preparing your application.

Check Your Credit Score Beforehand

Before applying for the Discover it card, it’s a good idea to check your credit score. Knowing your score can help you gauge your approval odds and identify any areas that may need improvement. You can obtain a free credit report from each of the three major credit bureaus once per year at AnnualCreditReport.com. Additionally, many credit card issuers and personal finance websites offer free credit score tracking services.

Ensure Accurate and Complete Information on the Application

When filling out the Discover it card application, be sure to provide accurate and up-to-date information. Double-check your personal details, income, and employment history to avoid any discrepancies that could delay or jeopardize your approval. Incomplete or inaccurate information may raise red flags and lead to a denied application.

Consider Income and Debt-to-Income Ratio

Your income and debt-to-income ratio play a significant role in determining your creditworthiness. Discover will consider your annual income and existing debt obligations when reviewing your application. A higher income and lower debt-to-income ratio can improve your chances of approval. If possible, pay down existing debts and avoid taking on new debt before applying for the Discover it card.

Additionally, if you have a lower income or limited credit history, consider becoming an authorized user on someone else’s credit card account or opening a secured credit card to help build your credit profile before applying for the Discover it card.

By following these tips and understanding the eligibility requirements, you can improve your odds of being approved for the Discover it card, you can increase your chances of being approved for the Discover it credit card and earning the $100 referral bonus.

Creative Ways to Make the Most of Your $100 Referral Bonus from Discover

Once you’ve met the requirements for the $100 referral bonus, you may be wondering how the bonus will be credited to your account and how you can use it. Let’s explore the details of bonus posting and redemption options.

Timeframe for Bonus Posting

After you’ve completed the necessary actions to earn the $100 referral bonus, such as making a minimum amount of purchases within the first three months, the bonus will be credited to your Discover it account within a specified timeframe. Typically, this occurs within 1-2 billing cycles after meeting the requirements. Keep an eye on your account statements and online dashboard for the bonus to appear.

Bonus Appears as Cashback

When the $100 referral bonus is credited to your Discover it account, it will appear as cashback rewards. This means that the bonus will be added to your cashback balance, which you can then redeem for various options, including statement credits, gift cards, merchandise, or charitable donations.

One of the most popular ways to use your $100 referral bonus is to redeem it for statement credits. This allows you to offset purchases you’ve made with your Discover it card, effectively reducing your account balance. To redeem your bonus for statement credits, simply log in to your Discover account online or through the mobile app and select the “Redeem Cashback” option.

Redeem for Gift Cards, Merchandise, or Charitable Donations

In addition to statement credits, you can also redeem your $100 referral bonus for other rewards, such as:

- Gift cards from popular retailers and restaurants

- Merchandise from Discover’s online shopping portal

- Charitable donations to participating non-profit organizations

- Direct deposits into your linked bank account

Discover offers a variety of redemption options for your cashback rewards. Log in to your account and navigate to the Cashback Bonus portal to see the available choices, which may include statement credits, gift cards, charitable donations, and more. Keep in mind that the value of your redemption may vary depending on the option you choose, with some gift cards or merchandise requiring more cashback to redeem compared to statement credits.

Discover it Card Review: Maximizing Rewards and Benefits Beyond the $100 Bonus

To get the most value from your Discover it credit card, it’s essential to understand how to optimize your cashback earnings and redeem your rewards strategically. Additionally, practicing responsible credit card use and financial management can help you avoid unnecessary debt and maintain a healthy credit profile.

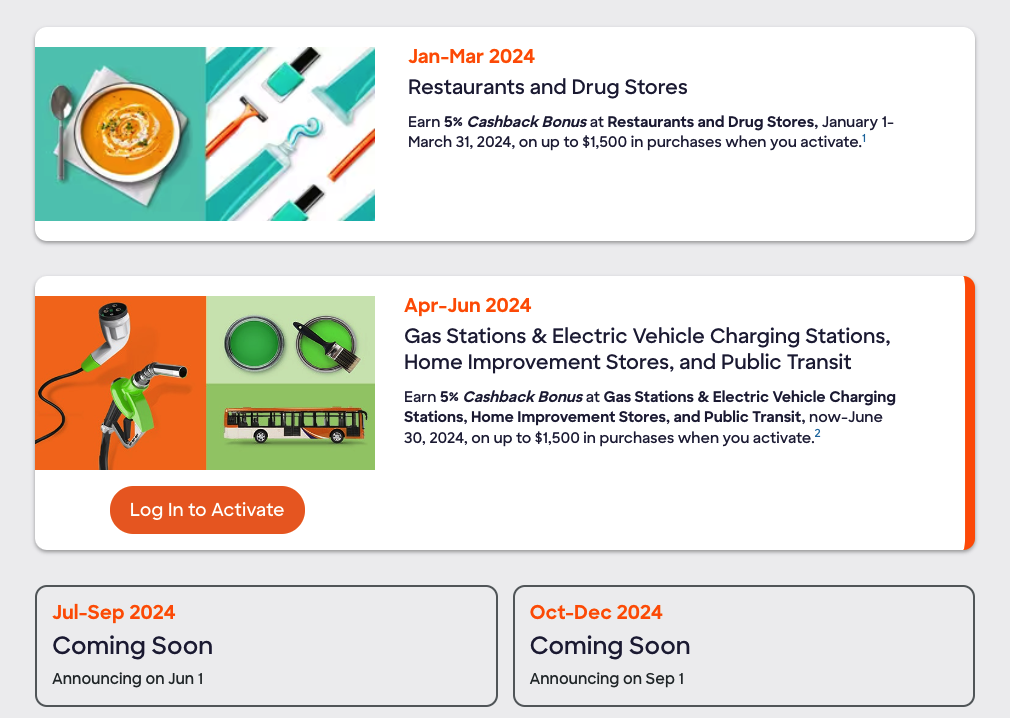

Optimizing Cashback Categories

One of the key features of the Discover it card is its rotating 5% cashback categories. These categories change every quarter and typically include popular spending areas such as grocery stores, gas stations, restaurants, and online shopping. To maximize your earnings with the Discover it card, consider the following strategie, keep track of the current bonus categories and prioritize spending in those areas when possible.

Additionally, you can earn unlimited 1% cashback on all other purchases. While this may seem like a small amount, it can add up quickly over time, especially on larger purchases or recurring bills. Use your Discover it card for everyday spending to steadily accumulate cashback rewards.

Redeeming Rewards Strategically

When it comes to redeeming your cashback rewards, it’s important to consider your options and choose the method that provides the most value for your needs. If you have a specific purchase in mind, redeeming your rewards for statement credits can directly offset the cost. However, if you’re looking for a gift or want to support a charitable cause, exploring the gift card and donation options may be more appealing.

Keep in mind that some redemption options, such as merchandise or certain gift cards, may require more cashback to redeem compared to statement credits. Be sure to compare the redemption rates and choose the option that aligns with your goals and provides the most value for your earned rewards.

Responsible Credit Card Use and Financial Management

While earning rewards and bonuses is an attractive feature of the Discover it card, it’s crucial to practice responsible credit card use and maintain healthy financial habits. This includes:

- Paying your balance in full each month to avoid interest charges

- Keeping your credit utilization low by not maxing out your credit limit

- Making payments on time to avoid late fees and negative impacts on your credit score

- Monitoring your account regularly for any suspicious activity or unauthorized charges

- Budgeting your expenses and avoiding overspending just to earn rewards

By following these responsible credit card use practices and maximizing your Discover it benefits, you can enjoy the rewards and perks of the card while maintaining a healthy financial profile.

Share the Wealth: How to Earn More Rewards by Referring Friends to Discover (Optional)

Once you’ve been approved for the Discover it credit card and have started enjoying its benefits, you may have the opportunity to earn additional bonuses by referring your friends and family. Discover’s referral program allows cardholders to share their unique referral link and earn a bonus when their referred friends or family members are approved for the card.

Generating a Referral Link After Card Approval

After you’ve been approved for the Discover it card, you can generate your unique referral link by logging into your account online or through the mobile app. Navigate to the referral program section, which may be labeled as “Refer a Friend” or something similar. Follow the prompts to create your personalized referral link, which will typically include a combination of your name and a unique code.

Sharing the Link with Friends and Family

Once you have your referral link, you can start sharing it with friends and family members who you think may be interested in applying for the Discover it card. Some effective ways to share your link include:

- Sending personal emails or messages to your contacts

- Posting your link on social media platforms (be sure to comply with each platform’s guidelines)

- Mentioning the referral opportunity in conversations about credit cards or personal finance

When your friends or family members use your unique referral link to apply for the Discover it card and are approved, you’ll typically earn a bonus, which may be in the form of cashback or a statement credit. The specific bonus amount and terms may vary, so be sure to check the referral program details in your account.

Remember, while referring friends and family can be a great way to earn additional bonuses, it’s important to respect their financial decisions and only share your link with those who you believe may genuinely benefit from the Discover it card and its features.

Discover Referral $100 Review: Is It the Right Choice for You?

The Discover it credit card offers an attractive combination of cashback rewards, introductory APR offers, and valuable perks, making it a strong choice for many consumers. With the added benefit of a $100 referral bonus, now is an excellent time to consider applying for the card and taking advantage of this special offer.

Throughout this article, we’ve explored the key features and benefits of the Discover it card, including:

- 5% rotating cashback categories and unlimited 1% cashback on all other purchases

- Introductory 0% APR on purchases and balance transfers for the first 14 months

- No annual fee and a range of additional perks like free FICO credit score access

- The ability to earn a $100 referral bonus by applying through our unique link

If you’re looking for a rewarding credit card with valuable features and a generous bonus offer, the Discover it card is definitely worth considering. By using our exclusive referral link to apply, you can ensure that you’re eligible for the $100 bonus once you’re approved and meet the requirements.

If you’re interested in applying for the Discover it Cash Back card and earning the $100 referral bonus, you can start the process by clicking the “Apply Now” button below. Keep in mind that approval is subject to credit review and not guaranteed.

Apply Now and Earn $100 Referral Bonus

Remember, the $100 referral bonus is a limited-time offer, so don’t miss out on this opportunity to maximize your rewards and save money on your everyday purchases. Apply for the Discover it credit card today and start earning cashback rewards and bonus savings!

Frequently Asked Questions About the Discover $100 Referral Bonus and Card Benefits

Here are answers to some of the most common questions about the Discover it Cash Back credit card and the $100 referral bonus offer:

| Question | Answer |

|---|---|

| What is the Discover referral bonus? | New applicants who are approved for the Discover it Cash Back credit card through a referral link can earn a $100 statement credit after making their first purchase within 3 months of account opening. |

| How do I apply for the Discover it card using the referral link to get the $100 bonus? | To apply for the Discover it Cash Back card and qualify for the $100 referral bonus, follow these steps: 1. Click on the provided referral link. 2. Fill out the online application form. 3. If approved, make a purchase within the first 3 months of account opening. |

| What are the key features of the Discover it Cash Back card? | 5% cash back on rotating categories (up to $1,500 quarterly), unlimited 1% cash back on all other purchases, 0% intro APR on purchases and balance transfers for 15 months, and the advantage of no annual fee. |

| How long does it take to receive the $100 referral bonus? | After you make your first purchase within 3 months of account opening, the $100 statement credit bonus will post to your account within 1-2 billing cycles. |

| What credit score is needed to qualify for the Discover it card? | While a good to excellent credit score (typically 670 or higher) is preferred, Discover also considers other factors such as income and debt-to-income ratio when evaluating applications. |

If you have any other questions or concerns about the Discover referral program or the credit card application process, feel free to reach out to Discover’s customer support team for further assistance.