Table of Contents

Introduction to Credit Cards in the USA

Why Credit Cards are Essential for Building Financial Foundation in the USA

Credit cards are essential tools in the financial system of the United States, especially for newcomers aiming to build a strong financial foundation. Here’s why having a credit card is important:

- Building Credit History: Establishing a good credit history is crucial for many aspects of life in the US. A good credit history can help you:

- Rent an apartment: Landlords often review credit scores to assess the reliability of potential tenants.

- Buy a car: Auto lenders use credit history to determine loan eligibility and interest rates.

- Secure a job: Some employers check credit reports as part of their hiring process.

- Convenience and Security: Credit cards offer unparalleled convenience for everyday purchases and enhanced security features, including:

- Fraud protection: Credit cards often include zero liability policies for unauthorized transactions, protecting you from fraud.

- Ease of use: Credit cards are widely accepted and make it easy to make purchases both in-store and online.

- Emergency funds: Having a credit card can provide a financial cushion in emergencies, allowing you to handle unexpected expenses.

- Rewards and Bonuses: Many credit cards offer various rewards and bonuses that can be highly beneficial:

- Cash back: Earn a percentage of your spending back as cash rewards, which can be used to reduce your balance or for other purposes.

- Travel rewards: Accumulate points or miles that can be redeemed for flights, hotel stays, and other travel-related expenses.

- Sign-up bonuses: Some cards offer significant bonuses for new cardholders after meeting a minimum spending requirement within a specified period. For example, the Discover IT card offers a $100 bonus after your first purchase.

Why Discover IT Credit Card is the Best Choice for U4U Refugees

For U4U refugees who are new to the United States and looking to build their credit history, choosing the right credit card is a crucial step. Among the many options available, the Discover IT Credit Card stands out as an excellent choice. Here are the key reasons why:

Key Advantages for U4U Refugees

For U4U refugees new to the US, selecting the right credit card is crucial for building a solid financial foundation. The Discover IT credit card stands out as an excellent choice for several reasons:

Easy Approval Process

The Discover IT credit card is designed to be accessible for individuals with limited or no credit history. This makes it an ideal option for U4U refugees who are starting to establish their financial presence in the United States. The application process is straightforward, and the approval criteria are accommodating for newcomers.

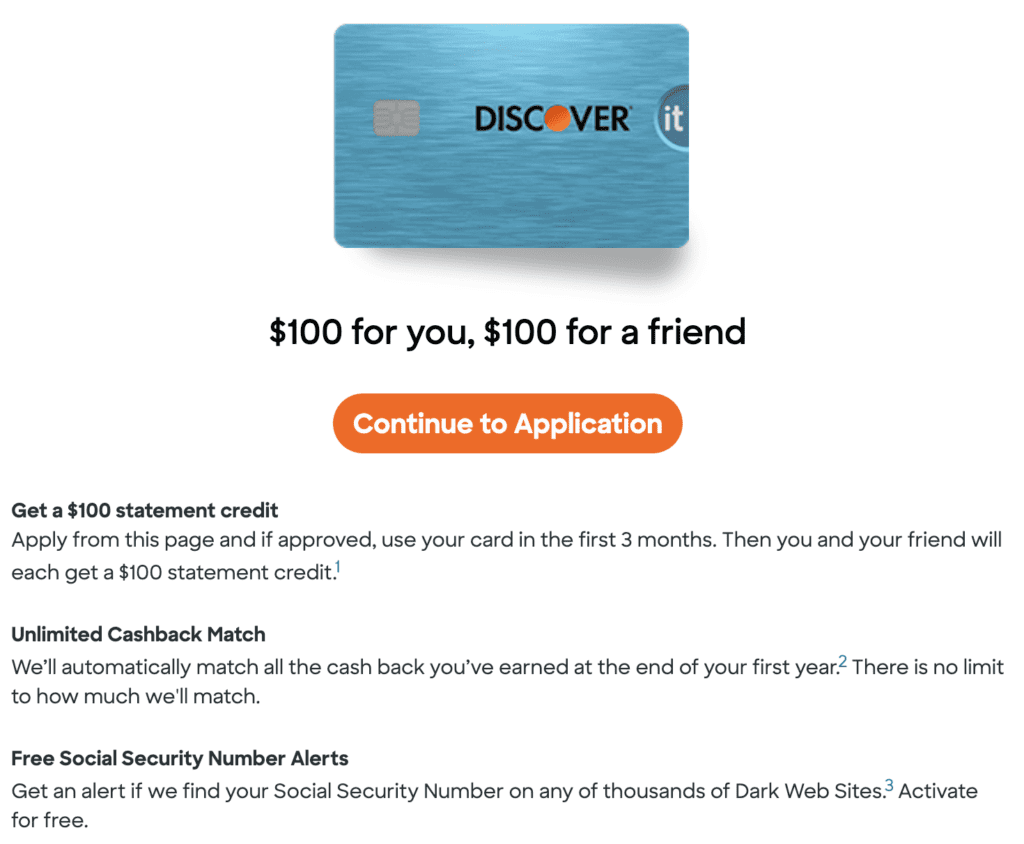

$100 Bonus for New Cardholders

One of the most attractive features of the Discover IT credit card is the $100 bonus offered to new cardholders. To qualify for this bonus, you simply need to make your first purchase within three months of opening the account. This bonus can provide a helpful boost to your finances as you settle into your new life in the US.

Cash Back Rewards

The Discover IT credit card offers a generous cash back rewards program, allowing you to earn money on your everyday purchases. Here’s how it works:

- 5% Cash Back on rotating categories each quarter, up to a quarterly maximum, when you activate. These categories can include places like grocery stores, gas stations, restaurants, and more.

- 1% Cash Back on all other purchases, providing consistent rewards for all your spending.

These rewards can be redeemed in various ways, including as statement credits, direct deposits, or even as gift cards. This flexibility allows you to make the most of your rewards in a way that suits your needs.

No Annual Fee

Another significant advantage of the Discover IT credit card is that it comes with no annual fee. This means you can enjoy all the benefits and rewards without worrying about an additional yearly cost. This is particularly beneficial for those who are budget-conscious and looking to maximize their financial resources.

Additional Benefits

The Discover IT credit card features a generous cash back rewards program, allowing you to earn cash back on your everyday purchases. Here’s how it works:

- 5% Cash Back on rotating categories each quarter, up to a quarterly maximum, when you activate. These categories can include grocery stores, gas stations, restaurants, and more.

- 1% on all other purchases, providing a consistent reward rate for all your spending.

You can redeem these rewards in various ways, including as statement credits, direct deposits, or even as gift cards. This flexibility allows you to make the most of your rewards in a way that best suits your needs.

No Annual Fee

Another significant benefit of the Discover IT credit card is that it has no annual fee. This means you can enjoy all the benefits and rewards without worrying about an extra yearly cost. This is particularly advantageous for those who are budget-conscious and looking to optimize their financial resources.

Additional Benefits

In addition to its core features, the Discover IT credit card provides additional perks to enhance your overall experience:

- Free FICO Credit Score: Monitor your credit health with free monthly access to your FICO credit score.

- Freeze It®: Instantly freeze your account if you misplace your card, providing added security and peace of mind.

- 24/7 Customer Service: Access friendly and knowledgeable customer support at any time, ensuring help is always available when you need it.

With these benefits, the Discover IT credit card helps you build credit while rewarding your everyday spending, making it a wise and pragmatic choice for U4U refugees in the USA.

Preparing to Apply for Your First Credit Card

Gathering Necessary Documents

Before applying for your first credit card, it’s essential to gather the necessary documents to ensure a smooth application process. Having these documents ready will help you avoid delays and increase your chances of approval. Here’s what you need:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN):

One of the primary requirements for applying for a credit card in the US is having a Social Security Number or an Individual Taxpayer Identification Number. These numbers are used by financial institutions to check your credit history and identify you in their systems.

If you don’t have an SSN, you can apply for an ITIN through the IRS. This step is crucial for non-citizens who need to report their taxes but are not eligible for an SSN. More information on how to obtain an ITIN can be found on the IRS website.

- Proof of Identity:

To verify your identity, you’ll need a government-issued identification document. Acceptable forms of ID include:

- Passport: A valid passport from your home country is widely accepted.

- Government-issued ID: This could be a driver’s license or a state ID card.

- Other government-issued documents: Some banks may accept other forms of ID, so check with the specific card issuer.

These documents help verify that you are who you claim to be, which is a critical step in preventing fraud.

- Proof of Address:

You’ll also need to provide proof of your current address. This is to verify your residential address. Commonly accepted documents include:

- Utility Bill: A recent utility bill (e.g., electricity, water, or gas) showing your name and address.

- Lease Agreement: A rental lease agreement with your name and address clearly listed.

- Bank Statement: A recent bank statement that includes your name and address.

These documents confirm your residence, which is necessary for receiving your credit card and important account information.

Ensuring you have these documents ready before you start your application will make the process smoother and more efficient. If you don’t have all these documents, it’s best to gather them first to avoid any issues during the application process.

Step-by-Step Application Process

1. Visit the Discover Website

1. Visit the Discover Website and Select the Discover IT Card

To begin the process, visit the Discover Credit Cards page and select the Discover IT card.

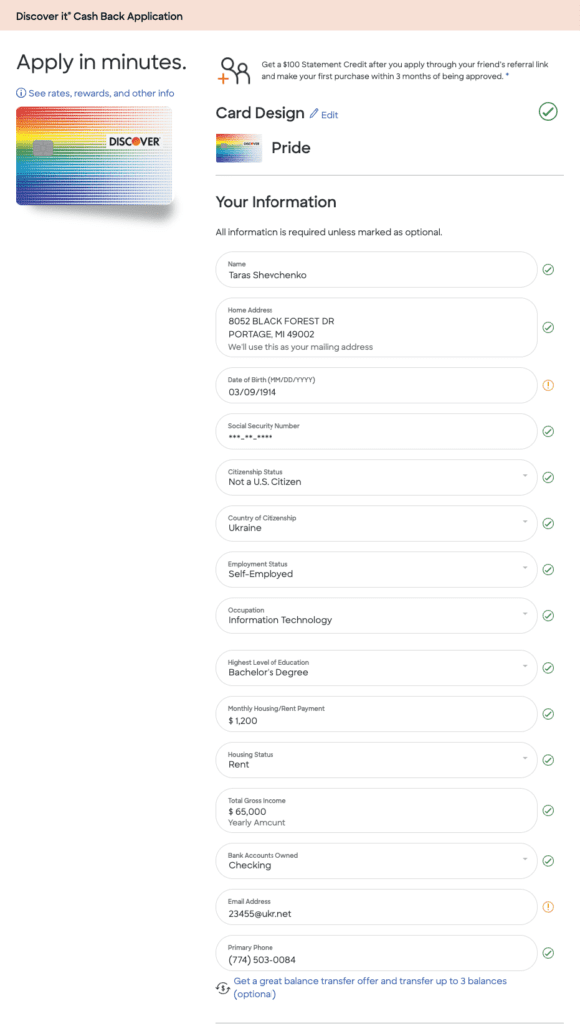

2. Fill Out the Application

The application form will require the following information:

- Personal Information:

- Name

- Date of Birth

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Contact Information:

- Address

- Phone Number

- Email Address

- Financial Information:

- Employment Status and Income

- Housing Information (Rent/Own)

- Monthly Mortgage/Rent Payment

- Name and Contact Information: Provide your full name, address, phone number, and email address. It’s essential to provide accurate contact details for communication and receiving your card.

- Social Security Number (SSN) or ITIN: This number is used to verify your identity and check your credit history. If you don’t have an SSN, you can use an Individual Taxpayer Identification Number (ITIN) instead.

- Income and Employment Details: Include information about your current employment status, employer, and annual income. This information is used to determine your creditworthiness.

Ensure all information is accurate to avoid any delays or issues with your application.

3. Submit Your Application

After filling out the application, review all details for accuracy. Once you are confident that everything is correct, submit the application. You will typically receive a response within a few minutes. If additional verification is needed, Discover may contact you for more information.

4. Receiving Your Card

If your application is approved, you will receive your Discover IT card in the mail within 7-10 business days. The card will be sent to the address you provided during the application process. Once you receive your card, you can activate it online or by phone and start using it to build your credit history and earn rewards.

Below is a table summarizing the key steps:

| Step | Action |

|---|---|

| 1 | Visit the Discover Credit Cards page and select the Discover IT card. |

| 2 | Fill out the application with personal, contact, SSN/ITIN, and income details. |

| 3 | Review and submit your application. Await a response. |

| 4 | If approved, receive your card by mail within 7-10 business days. |

For more details and to start your application, visit the Discover Credit Cards Page.

Apply Now and Earn $100 Bonus

Tips for Using Your First Credit Card

As a new credit card user, it’s essential to develop good habits from the start. Responsible credit card use will help you build a strong credit history, avoid debt, and take advantage of the many benefits credit cards offer.

Managing Your Credit Responsibly

Responsible use of your first credit card is crucial for building a strong credit history and avoiding debt. Here are some practical tips to help you manage your credit card effectively:

- Pay Your Bill on Time

Timely payments are essential for maintaining a good credit score. Always pay at least the minimum amount due by the due date to avoid late fees and interest charges. Setting up automatic payments or reminders can help ensure you never miss a payment.

- Keep Your Balance Low

Try to keep your credit card balance below 30% of your credit limit. This is known as your credit utilization ratio, and it significantly impacts your credit score. High balances can indicate a risk to lenders, so it’s best to keep your balances low.

- Regularly Monitor Your Account

Frequently check your credit card account for any unauthorized transactions and track your spending. Most credit card issuers offer online and mobile account access, making it easy to monitor your account activity. Keeping an eye on your account can help you catch any suspicious activity early and manage your spending effectively.

By following these tips, you can use your credit card responsibly and build a strong credit history. A good credit score can lead to better interest rates on loans, higher credit limits, and other financial opportunities in the future. Start implementing these practices today to set yourself up for long-term financial success.

Additional Tips for New Cardholders

Here are some additional tips to help you make the most of your first credit card:

- Understand Your Terms

Fully understand the terms and conditions of your credit card, including the interest rate, fees, and rewards program details. Being aware of these terms can help you avoid unexpected charges and maximize your benefits.

- Use Rewards Wisely

If your card offers rewards, such as cash back or points, use them to your advantage. Make purchases that align with the reward categories and redeem your rewards regularly to get more value from your card.

- Avoid Cash Advances

Cash advances usually come with high fees and interest rates. It’s best to avoid using your credit card for cash advances unless absolutely necessary. Instead, plan your finances to cover your cash needs without resorting to this costly option.

Using your credit card responsibly can lead to many financial benefits, including building a strong credit history and taking advantage of rewards. By following these tips, you can ensure that your first experience with credit is positive and beneficial.

Remember, your credit card is a powerful financial tool when used wisely. By developing good habits early on and staying informed about your card’s terms and benefits, you can make the most of your credit card while avoiding potential pitfalls.

Frequently Asked Questions

We understand that you may have questions about applying for and using your first credit card. To help you make informed decisions, we’ve compiled a list of frequently asked questions and their answers below. If you don’t find the information you’re looking for, feel free to reach out to us for further assistance.

| Question | Answer |

|---|---|

| What documents do I need to apply for a credit card? | To apply for a credit card, you need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), proof of identity (such as a passport or government-issued ID), and proof of address (like a utility bill or lease agreement). |

| How do I apply for the Discover IT credit card? | Visit the Discover Credit Cards page, select the Discover IT card, and fill out the application form with your personal information. Review the details for accuracy and submit the application. You should receive a response within a few minutes. |

| What are the benefits of the Discover IT credit card? | The Discover IT credit card offers easy approval, a $100 bonus for new cardholders after their first purchase, 5% cash back on rotating categories, 1% cash back on other purchases, and no annual fee. It also provides additional benefits like free FICO credit scores and 24/7 customer service. |

| How can I build a good credit history? | To build a good credit history, pay your bills on time, keep your balance low (below 30% of your credit limit), and regularly monitor your account for unauthorized transactions. Responsible credit usage can help you improve your credit score over time. |

| What should I do if my application is denied? | If your application is denied, review the reasons provided by the issuer. Common reasons include insufficient credit history or income. Consider addressing these issues and reapplying later. You can also explore other credit card options that might have different approval criteria. |

| What is a cash advance and should I use it? | A cash advance allows you to withdraw cash from your credit card, but it usually comes with high fees and interest rates. It’s best to avoid using cash advances unless absolutely necessary and explore other financial options first. |

| How can I maximize my credit card rewards? | To maximize your credit card rewards, use your card for purchases that align with the reward categories, such as groceries or gas. Redeem your rewards regularly and take advantage of any bonus offers or promotions provided by the card issuer. |

Leave a Reply