Best Chase Ink Business Credit Cards for Real Estate Agents

The best Chase Ink business credit cards for real estate agents are the Ink Business Preferred®, Ink Business Unlimited®, and Ink Business Cash®. These cards offer valuable rewards, bonus categories, and benefits tailored to the needs of real estate professionals.

-Why did the real estate agent bring a credit card to the open house?

-Because the best deals always come with “no interest” for the first year! 🙂

As a real estate agent, having a dedicated business credit card can be a game-changer for managing your finances and growing your business. The right business credit card for real estate agents offers a range of benefits, including:

- Streamlined expense management, making it easier to track and categorize business purchases

- Improved cash flow management through features like 0% introductory APR periods and sign-up bonuses

- Valuable rewards on purchases in categories relevant to real estate agents, such as office supplies, advertising, and travel

- Additional perks that can save time and money, such as travel benefits, purchase protections, and expense management tools

Chase offers a range of Ink Business credit cards that cater to the unique needs and spending patterns of real estate professionals. In this article, we’ll explore the best Chase Ink Business credit cards for real estate agents, evaluating each card based on criteria such as:

- Rewards structure and earning potential in categories relevant to real estate professionals

- Introductory offers and sign-up bonuses

- Annual fees and long-term value

- Expense management tools and additional benefits

By understanding these key factors, you’ll be well-equipped to choose the best Chase Ink Business credit card for your real estate business, allowing you to maximize rewards, simplify expense tracking, and access valuable perks that can help your business thrive.

Key Features Real Estate Agents Need in a Business Credit Card

When selecting the best business credit card for real estate agents, it’s essential to consider features that align with the unique needs and spending patterns of your business. Here are the key features to look for:

Rewards and Benefits

Rewards earned through a business credit card can add significant value to your real estate business. Look for cards that offer:

- Cash back, points, or miles on purchases you frequently make, such as office supplies, advertising, and travel

- Bonus rewards in categories relevant to real estate agents

- Flexible redemption options, such as statement credits, travel bookings, or gift cards

Introductory Offers

Many business credit cards feature introductory offers that can provide a significant boost to your business finances. These may include:

- 0% APR periods on purchases, allowing you to make large investments in marketing or equipment without incurring interest charges for a set time

- Generous sign-up bonuses that can be earned by meeting minimum spending requirements within the first few months of account opening

Annual Fees

Some business credit cards charge annual fees, while others do not. When considering a card with an annual fee, assess whether the rewards, benefits, and features justify the cost. In some cases, a card with a higher annual fee may provide greater long-term value for your real estate business.

Expense Management Tools

Look for business credit cards that offer robust expense tracking and management tools, such as:

- Automatic categorization of expenses

- Integration with popular accounting software

- Detailed spending reports and analytics

- Receipt capture and storage

These features can save you time and simplify bookkeeping, tax preparation, and financial decision-making for your real estate business.

Additional Perks

Many business credit cards for real estate agents offer additional perks that can provide value and convenience. These may include:

- Travel benefits, such as airport lounge access, travel insurance, and TSA PreCheck or Global Entry credits

- Purchase protection and extended warranty coverage for eligible items bought with the card

- Cell phone protection when you pay your monthly bill with the card

- Free employee cards to simplify expense tracking and earn additional rewards

Consider which perks align with your business needs and priorities when selecting the best business credit card for your real estate business.

Review of Top Chase Ink Business Credit Cards for Real Estate Agents

Now that we’ve explored the key features to look for in a business credit card for real estate agents, let’s dive into a detailed review of three top options from Chase’s Ink Business card series.

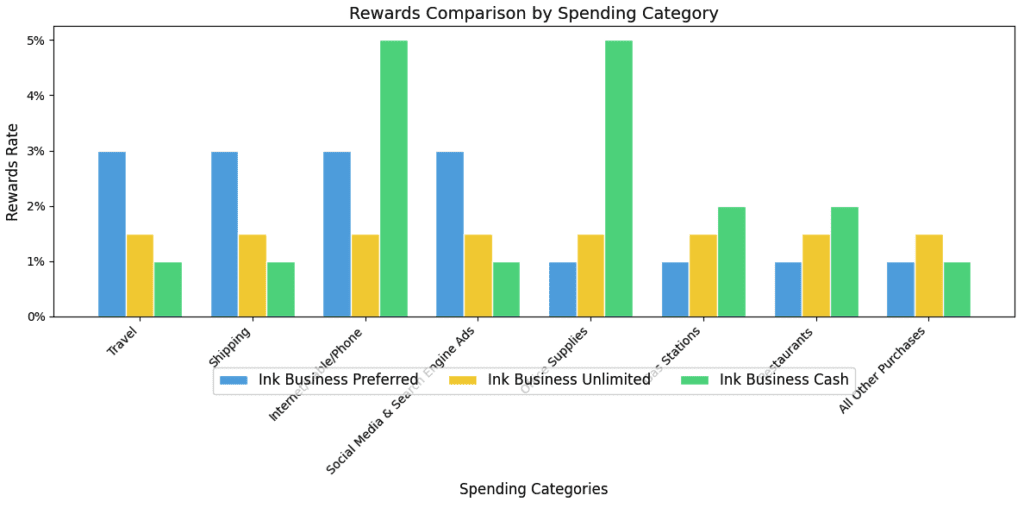

| Card | Rewards | Sign-Up Bonus | Intro APR | Annual Fee |

|---|---|---|---|---|

| Ink Business Preferred® | 3X points on select categories | 100,000 points after spending $15,000 in the first 3 months | N/A | $95 |

| Ink Business Unlimited® | 1.5% cash back on all purchases | $750 bonus cash back after spending $6,000 in the first 3 months | 0% for 12 months | $0 |

| Ink Business Cash® | 5%, 2%, or 1% cash back on select categories | $750 bonus cash back after spending $6,000 in the first 3 months | 0% for 12 months | $0 |

Each of these Ink Business credit cards caters to the unique needs and spending patterns of real estate agents. Consider your business expenses, preferred rewards structure, and the value of additional benefits when selecting the best fit for your real estate business.

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is an excellent choice for real estate agents seeking a balance of rewards, benefits, and flexibility.

- Earn 100,000 bonus points after you spend $15,000 on purchases in the first 3 months from account opening

- Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, and on advertising purchases made with social media sites and search engines each account anniversary year

- Earn 1 point per $1 on all other purchases with no limit to the amount you can earn

- Points are worth 25% more when you redeem for travel through Chase Ultimate Rewards®

- $95 annual fee

Ink Business Unlimited® Credit Card

The Ink Business Unlimited® Credit Card offers straightforward cash back rewards without the hassle of tracking bonus categories.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- 0% introductory APR for 12 months from account opening on purchases, then a variable APR of 18.49% – 24.49%

- No annual fee

Ink Business Cash® Credit Card

The Ink Business Cash® Credit Card provides impressive cash back rewards in categories relevant to real estate agents, all with no annual fee.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- Earn 1% cash back on all other card purchases with no limit to the amount you can earn

- 0% introductory APR for 12 months from account opening on purchases, then a variable APR of 18.49% – 24.49%

- No annual fee

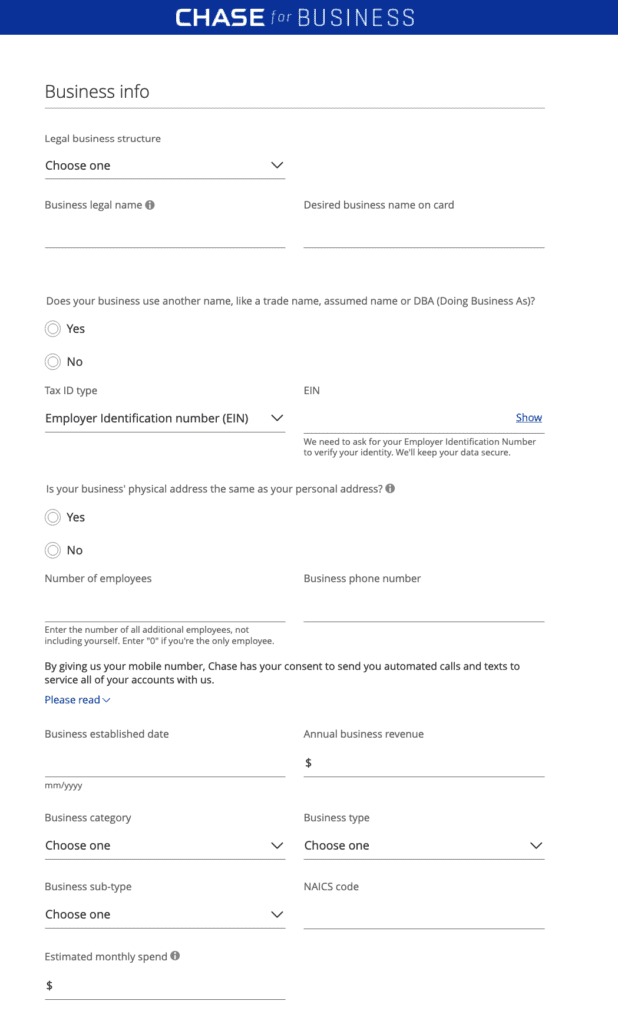

How to Apply for a Chase Ink Business Credit Card

Applying for a Chase Ink Business credit card is a straightforward process that can be completed online. Here’s a step-by-step guide to help you through the application:

Step 1: Gather Required Information

Before beginning the application, ensure you have the following information readily available:

- Personal information: Full name, date of birth, Social Security number, and mother’s maiden name

- Authorizing officer title: The title or position of the person in the company who has the right to sign and submit the application.

This information can be found in corporate documents such as meeting minutes or power of attorney. If you are the sole owner of the business, indicate “Owner” or “Sole Proprietor”. - First name and Middle name (optional): The first and middle name (if applicable) of the authorizing officer.

Use your official name as stated on your ID. - Last name and Suffix (optional): Last name and suffix (if applicable), such as Jr. or Sr.

Provide your official last name and suffix, if you have one. - Date of birth: Date of birth of the authorizing officer.

Enter your date of birth in the specified format. - Mother’s maiden name: Mother’s maiden name of the authorizing officer.

This is an additional level of security. If you don’t know your mother’s maiden name, try to find out from relatives or look it up on your birth certificate. - Tax ID type and Social Security number: Type of tax identification number – for US citizens, this is usually SSN (Social Security Number).

Use your personal Social Security number. If you don’t remember it, it is listed on your Social Security card or tax documents. - Address type: Type of address, in this case domestic.

Select “Domestic” if you reside within the USA. - Street address, Suite/apt/other (optional), ZIP code, City, State: The mailing address of the authorizing officer, including street, house/apartment/office number (if applicable), ZIP code, city and state.

Provide your current mailing address. If you have recently moved, use the new address and update it in all important documents. - Email address and Phone number: Email address and phone number for contact.

Provide your primary email address and phone number that you check regularly. - Notice about consent to automated calls and texts from Chase when providing a mobile number.

Read the notice and indicate whether you agree to receive automated calls and messages from the bank. - Total gross annual income: The total annual pre-tax income of the authorizing officer.

Specify your personal annual income from all sources, including salary, investments, rent, etc. This information can be found in tax returns or income statements. - Legal business structure: The legal structure of the business – here you need to choose the form of doing business (e.g., sole proprietor, LLC, etc.).

This information can be found in the company’s registration documents or clarified with a lawyer or accountant. - Business legal name: The official name of the company registered with the relevant authorities.

It is specified in the registration certificate or other constituent documents. - Desired business name on card: The name that will be displayed on the issued credit or debit card.

You can use the official name or its abbreviated version if it is too long. - Does your business use another name: Indicates if the business is also known under another name or trade name (DBA – Doing Business As).

If your company has a registered DBA, specify it here. - Tax ID type and Employer Identification Number (EIN): Type of tax identifier and employer identification number – a federal number used to identify a business for tax purposes.

EIN can be found in tax documents or requested from the IRS if it is missing. - Is your business’ physical address the same as your personal address?: Specifies whether the physical address of your business matches your personal address.

If your company does not have a separate office, you can provide your home address. - Number of employees: The total number of people working in the company.

Include all full-time and part-time employees, as well as yourself as the business owner. - Business phone number: The contact number for reaching the business.

If your company does not have a separate number, you can provide your personal mobile or home phone. - Business established date: When the company was registered or started operating.

This information is in the registration documents or lease agreements. - Annual business revenue: The total amount of revenue the company received over the past year.

Can be found in financial statements or tax returns. For a new business, the expected income is indicated. - Business category, Business type, and Business sub-type: Classification of the business by industry and field of activity.

Choose the options that most accurately describe your company’s activities. - NAICS code: The North American Industry Classification System code – a standard code used to classify business operations.

The code can be found on the NAICS website by entering keywords describing your business. - Estimated monthly spend: The amount the company plans to spend each month using this business card.

Estimate how much your company spends on purchases that can be paid for with a business card, such as office supplies, travel, etc. - Ensure your credit score is in good standing (generally 680 or higher)

- Have a solid business plan and financial projections ready, if requested

- Provide accurate and consistent information on your application

- Avoid applying for multiple credit cards within a short period, as this can negatively impact your credit score

- Office supplies

- Advertising, especially online and on social media platforms

- Telecommunications services

- Travel, including airfare, hotels, and car rentals

- Gas and dining, if you frequently take clients out or drive to properties

- Ongoing rewards rates in categories relevant to your business

- Annual fees and whether the benefits justify the cost

- Long-term perks, such as cell phone protection or travel insurance

- Office supplies

- Advertising, especially online and on social media platforms

- Telecommunications services

- Travel, including airfare, hotels, and car rentals

- Gas and dining, if you frequently take clients out or drive to properties

- Ongoing rewards rates in categories relevant to your business

- Annual fees and whether the benefits justify the cost

- Long-term perks, such as cell phone protection or travel insurance

Business Information

When applying for a Chase business card, you will need to provide basic information about your business:

Important: When specifying the business name, do not use fictitious names unless you have an officially registered DBA. Otherwise, Chase may request supporting documents, and your application will be declined.

After entering all the necessary information, carefully review the card’s terms of service and confirm your agreement with them by checking the appropriate box. Make sure all data is entered correctly, and click the “Submit Application” button.

If you have difficulties filling out the business information when applying for a Chase business card, contact the bank’s customer support for assistance. Chase specialists will help you understand all the nuances and increase the chances of your application being approved.

Review and Submit

Before submitting your application, carefully review all the information you’ve provided for accuracy. Read the terms and conditions, and if you agree, submit your application.

Wait for a Decision

After submitting your application, Chase will review your information and make a decision. This process can take anywhere from a few minutes to several days. If approved, you’ll receive your new Chase Ink Business credit card in the mail within 7-10 business days.

Tips for Maximizing Your Chances of Approval

To increase your likelihood of being approved for a Chase Ink Business credit card, consider the following tips:

By following these tips and providing accurate information on your application, you’ll be well on your way to securing the best Chase Ink Business credit card for your real estate business.

How to Choose the Best Chase Ink Business Credit Card for Your Real Estate Business

With three excellent Chase Ink Business credit card options available, it’s essential to select the one that best aligns with your real estate business’s unique needs and spending patterns. Consider the following factors when making your decision:

Identify Your Business Spending Patterns

Before choosing a Chase Ink Business credit card, analyze your business expenses to determine where you spend the most money. This will help you select a card that offers the highest rewards in categories relevant to your real estate business, such as:

Consider Your Business’s Financial Health

Evaluate your real estate business’s financial situation and cash flow when selecting a Chase Ink Business credit card. If you anticipate needing to carry a balance in the short term, prioritize cards with introductory 0% APR periods on purchases, such as the Ink Business Unlimited® or Ink Business Cash®. On the other hand, if you plan to pay your balance in full each month, focus on cards with higher rewards rates and valuable perks, like the Ink Business Preferred®.

Look at Long-Term Value vs. Short-Term Gains

While generous sign-up bonuses can be attractive, it’s crucial to consider the long-term value a Chase Ink Business credit card offers your real estate business. Evaluate factors such as:

A card with a lower sign-up bonus but better ongoing rewards and benefits, like the Ink Business Cash®, may provide greater value in the long run than a card with a higher bonus but fewer ongoing perks.

Assess Your Travel Needs

If your real estate business involves frequent travel, whether for conferences, training, or meeting out-of-town clients, consider the travel benefits offered by each Chase Ink Business credit card. The Ink Business Preferred® stands out in this regard, offering valuable perks like trip cancellation/interruption insurance, auto rental collision damage waivers, and the ability to transfer points to popular travel partners.

By carefully evaluating your real estate business’s unique needs and spending patterns, you can select the best Chase Ink Business credit card to help you maximize rewards, manage cash flow, and grow your business. Remember to compare the features and benefits of each card and read the fine print to ensure you’re making an informed decision that benefits your business in the long term.

How to Choose the Best Chase Ink Business Credit Card for Your Real Estate Business

With three excellent Chase Ink Business credit card options available, it’s essential to select the one that best aligns with your real estate business’s unique needs and spending patterns. Consider the following factors when making your decision:

Identify Your Business Spending Patterns

Before choosing a Chase Ink Business credit card, analyze your business expenses to determine where you spend the most money. This will help you select a card that offers the highest rewards in categories relevant to your real estate business, such as:

Consider Your Business’s Financial Health

Evaluate your real estate business’s financial situation and cash flow when selecting a Chase Ink Business credit card. If you anticipate needing to carry a balance in the short term, prioritize cards with introductory 0% APR periods on purchases, such as the Ink Business Unlimited® or Ink Business Cash®. On the other hand, if you plan to pay your balance in full each month, focus on cards with higher rewards rates and valuable perks, like the Ink Business Preferred®.

Look at Long-Term Value vs. Short-Term Gains

While generous sign-up bonuses can be attractive, it’s crucial to consider the long-term value a Chase Ink Business credit card offers your real estate business. Evaluate factors such as:

A card with a lower sign-up bonus but better ongoing rewards and benefits, like the Ink Business Cash®, may provide greater value in the long run than a card with a higher bonus but fewer ongoing perks.

Assess Your Travel Needs

If your real estate business involves frequent travel, whether for conferences, training, or meeting out-of-town clients, consider the travel benefits offered by each Chase Ink Business credit card. The Ink Business Preferred® stands out in this regard, offering valuable perks like trip cancellation/interruption insurance, auto rental collision damage waivers, and the ability to transfer points to popular travel partners.

By carefully evaluating your real estate business’s unique needs and spending patterns, you can select the best Chase Ink Business credit card to help you maximize rewards, manage cash flow, and grow your business. Remember to compare the features and benefits of each card and read the fine print to ensure you’re making an informed decision that benefits your business in the long term.

Conclusion

Choosing the right Chase Ink Business credit card for your real estate business involves careful consideration of your spending patterns, financial situation, and long-term goals. By understanding the key features and benefits offered by the Ink Business Preferred®, Ink Business Unlimited®, and Ink Business Cash® cards, you can make an informed decision that helps you maximize rewards, simplify expense management, and access valuable perks to grow your business.

Remember to use your chosen Chase Ink Business credit card responsibly by paying your balance in full each month, staying within your credit limit, and regularly monitoring your account for any suspicious activity. By doing so, you’ll not only avoid costly interest charges and fees but also build a strong credit history for your real estate business.

As your business grows and evolves, periodically reassess your credit card needs to ensure you’re still using the best card for your changing circumstances. With the right Chase Ink Business credit card in your wallet, you’ll be well-equipped to manage your finances, earn valuable rewards, and achieve your real estate business’s goals.

Leave a Reply