Understanding the Discover Referral: Your $50 or $100 Bonus

The Discover credit card referral program in 2025 offers one of the most generous bonuses on the market. As of May 2025, it provides a **$100 statement credit** to both the existing cardmember and the new applicant. This is a significant incentive if you’re looking to get a new Discover card or help a friend sign up. Understanding this program can put extra cash back in your pocket. This guide explains how the “Discover referral $100” bonus works and how to maximize its benefits.

Whether you are the one referring or the one being referred, the Discover referral program currently provides a **$100 statement credit** as an incentive. This $100 offer is standard as of May 2025, though the exact bonus amount can vary based on current promotions. Always check the specific offer details linked to the referral.

How to Secure Your $100 Discover Referral Bonus

Claiming your Discover referral bonus involves a few simple steps for both the person referring and the new applicant.

For Those Referring (Existing Discover Cardholders):

- Log In to Your Discover Account: Access your account via the official Discover website (discover.com) or mobile app.

- Locate Your Unique Referral Link: Look for a “Refer a Friend,” “Invite Friends,” or similar section. This is where you’ll find your personalized link for the $100 Discover referral.

- Share Your Link: Distribute your link to friends or family interested in a Discover card. Email, text, or social media are great ways to share. Highlight the potential $100 bonus they can receive. Remember, you can refer a maximum of 5 friends per calendar year, earning up to $500 annually in referral credits.

- Earn Your Bonus: When your friend applies *through your link*, gets approved for a qualifying Discover card, and makes their first *qualifying* purchase (usually within the first three months), you’ll typically see your $100 referral bonus credited to your account within 1-2 billing cycles.

For New Applicants (Getting Referred):

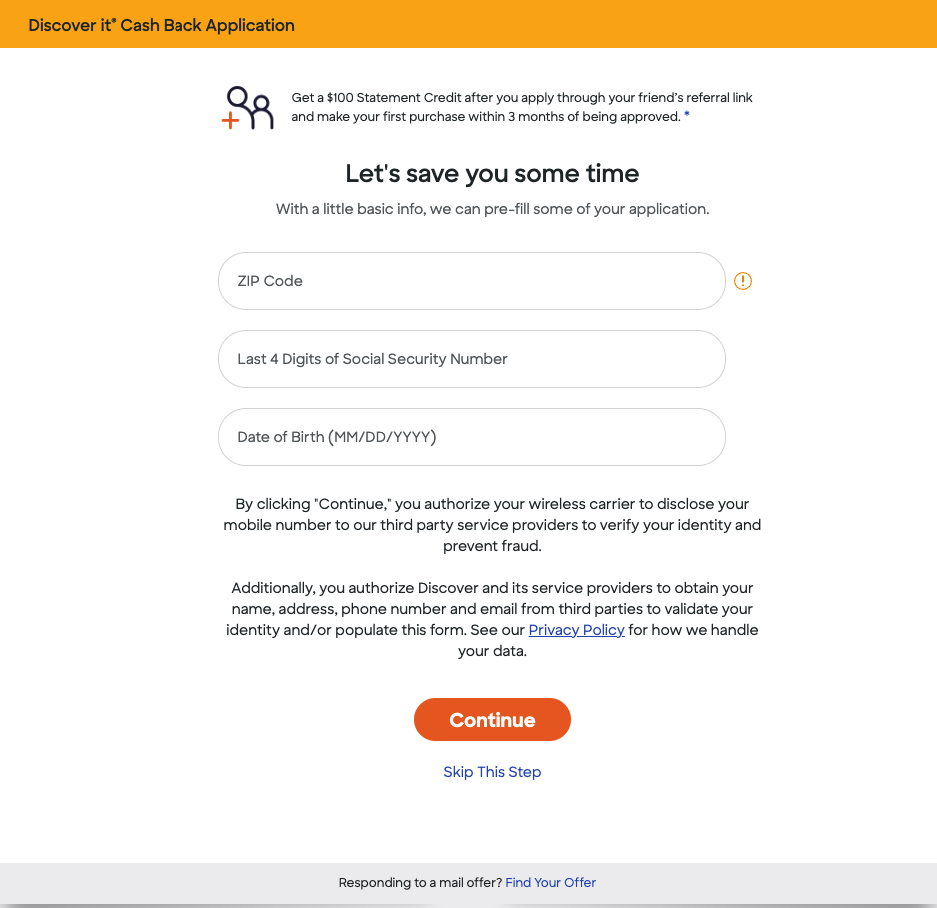

- Use a Valid Referral Link: Crucially, you *must* apply using a referral link provided by an existing Discover cardmember to be eligible for the $100 bonus. Applications via phone, mail, or other digital channels without a link do not qualify.

- Apply and Get Approved: Complete the application for an eligible Discover card using the referral link. The application process is straightforward.

Applying for a Discover card through a referral link can net you a $50 or $100 bonus. - Make Your First Purchase: Once approved, use your new Discover card to make your first purchase within the timeframe specified in the referral offer terms (typically the first three months).

- Receive Your $50 or $100 Bonus: The statement credit, whether it’s the $50 Discover referral bonus or the $100 Discover referral bonus, should appear in your account within 1-2 billing cycles after meeting the conditions.

Key Tip: The Discover referral bonus amount is currently $100 as of May 2025. Always confirm the details of the specific offer tied to the referral link you’re using, but the $100 bonus is one of the most competitive on the market.

Capital One Merger: What It Means for Your Discover Card and Referrals

On May 18, 2025, Discover Bank officially merged with Capital One, N.A. However, for existing Discover cardmembers, the Discover brand and all associated programs, including the referral program, continue to operate as before. You can still use your existing logins on discover.com and the Discover mobile app. All bonuses, rewards, and benefits remain unchanged.

It’s important to note that Discover benefits do not currently transfer to Capital One accounts, and vice versa. Continue to manage your Discover accounts as usual. You cannot make payments on Discover cards at Capital One branches or cafes at this time. The referral program continues to function solely within the Discover system.

Why Choose a Discover Card for the $50/$100 Referral?

Beyond the attractive $50 or $100 referral bonus, Discover cards are known for several valuable features:

- Cashback Match™: At the end of your first year, Discover often matches *all the cash back you’ve earned from purchases*. This means your effective rate in bonus categories can be 10% and on standard purchases 2% during the first year. *Note: The $100 referral bonus is a statement credit and is not doubled by Cashback Match™.*

- Rewards on Everyday Spending: Earn cash back or miles on purchases. For 2025, Discover It cards feature rotating 5% cash back categories on up to $1,500 in spending each quarter (1% after that).

- Q1 2025 (Jan-Mar): Restaurants, Home Improvement Stores, and select Streaming Services.

- Q2 2025 (Apr-Jun): Grocery Stores and Wholesale Clubs.

- Remember to activate bonus categories each quarter via the Discover website or app.

- No Annual Fee Options: Many popular Discover cards come with no annual fee.

- Excellent Customer Service: Access to U.S.-based customer support.

- Free Credit Score Monitoring: Keep an eye on your FICO® Score.

Strategies to Maximize Your Discover Benefits (Including Referrals)

- Coordinate Referrals with Family: Experienced users often coordinate referrals within a household. If partners refer each other, each can potentially earn a $100 new cardmember bonus *plus* a $100 referrer bonus, totaling $200 per person or $400 per couple just from the initial bonuses. (Remember the 5 referral/year limit per person).

- Optimize Cashback with Gift Cards: Experts recommend redeeming earned cash back for gift cards instead of direct statement credit or bank deposit, as Discover often offers boosted value for gift card redemptions (e.g., $100 gift card for $85 cashback). This strategy is especially powerful when combined with the first-year Cashback Match™.

The $100 referral program is a great entry point to these valuable features.

Visual Insights: Discover Card Program Overview

Important Details and Limitations of the Discover Referral Program

While the Discover referral program is generous, keep the following details in mind:

- Eligibility to Refer: Not all Discover cardholders can refer. Holders of the Discover it® Secured Credit Card and Discover it® Business Card are ineligible. For other cards, eligibility typically begins after your first billing period is complete, and your account must be open and in good standing.

- Eligibility to Be Referred: Individuals who already have a Discover card or who have opted out of receiving marketing communications from Discover cannot be referred.

- Tracking Referrals: Discover does not generally notify you whether a specific referral application was approved or declined. You can typically only track the status of your referrals by checking your account for the bonus statement credit.

- Tax Implications: Referral credits received may be considered taxable income. Discover recommends consulting with a tax advisor, especially if you are actively participating and earning close to the $500 annual limit from referrals.

FAQ: Your Discover Referral $100 Questions

How much is the Discover referral bonus in May 2025?

As of May 2025, the Discover referral bonus is typically $100 for both the referrer and the new cardmember. This is the standard offer, though promotional amounts can vary over time.

What do I need to do to get a $100 referral bonus from Discover?

If you’re referring someone, share your unique Discover referral link. If you’re applying, use a friend’s referral link. The new cardmember must be approved for an eligible card and make their first qualifying purchase (within the first three months, excluding balance transfers/cash advances) for both parties to receive the $100 statement credit within 1-2 billing cycles.

Is the Discover $100 referral bonus the only offer available?

While $100 is the common offer as of May 2025, Discover may run different promotions periodically. Always check the terms of the specific referral link you are using.

Are there limits to how many people I can refer for the bonus?

The Discover referral bonus can be either $50 or $100, and sometimes other amounts. It depends on the specific promotion active at the time of the referral. Both the person referring and the new cardmember usually get the same bonus amount after all conditions are met.

What do I need to do to get a $50 or $100 referral bonus from Discover?

No, as of May 2025, the merger with Capital One has not affected the Discover referral program. The program continues to operate under the Discover brand with the same terms and benefits.

How long does it take to receive the Discover referral $100 credit?

Typically, the $100 statement credit is applied to both accounts within 1-2 billing cycles after the new cardmember is approved and fulfills the initial qualifying purchase requirement.

Who is NOT eligible to participate in the Discover referral program?

Holders of the Discover it® Secured Credit Card and Discover it® Business Card cannot refer others. Individuals who currently have a Discover card or have opted out of marketing communications cannot be referred. Referring cardholders must also have an open account in good standing.

Conclusion: Maximize Your Rewards with Discover Referrals in 2025

The Discover referral program in 2025 stands out as one of the most rewarding ways to earn a bonus when getting a new credit card. The combination of a generous **$100 bonus** for both parties, a low activation threshold (just one qualifying purchase within three months), and the continued operation of the program despite the merger with Capital One makes it particularly attractive.

By understanding the program details, adhering to the limits, and employing smart strategies like coordinating referrals with family and optimizing cashback redemptions, participants can significantly enhance their overall value from using Discover cards. Don’t miss out on the opportunity to earn a $100 statement credit through this straightforward and beneficial program.