Discover credit card referral program offers a $100 bonus upon approval and first purchase. Learn how to maximize referral benefits and use your Discover card responsibly.

- Introduction

- Discover Credit Card Benefits

- Potential Changes to the Referral Program and Bonus Structure

- Step-by-Step Guide to Applying for a Discover Credit Card

- Maximizing Referral Benefits

- Responsible Credit Card Usage for Students and others

- Conclusion

General Recommendations

- Start with Discover To apply for a Discover credit card, click on the https://refer.discover.com/ Referral Link

- Use the actual address where the card will be sent if approved.

- Use the approximate income of the family or the applicant when filling out the application. Even if you do not yet have a job or income, the bank does not need a client with zero income. The average income is estimated to be from 40 to 60 thousand dollars, which is enough in most cases to approve your application

- Avoid applying to other banks: There is a high risk of rejection when applying to several banks at the same time for a credit card.

Taking into account the terms and conditions of the bank: Each bank has its conditions and requirements for potential customers, so it is important to read them carefully before applying.

- Introduction

1.1 Overview of the Discover credit card referral program

The Discover credit card referral program is an excellent opportunity for students to benefit from a rewarding credit card while also helping their friends and family members earn a bonus. Discover, a well-established and reputable financial institution, offers a range of credit cards tailored to the needs of students, providing them with a convenient way to build their credit history and earn cash back rewards on their purchases.

The referral program allows current Discover credit card holders to share their unique referral link with others. When a friend or family member applies for a Discover credit card using this link and is approved, both the referrer and the new cardholder receive a bonus. This program not only benefits the new cardholder but also rewards the existing cardholder for their loyalty and advocacy.

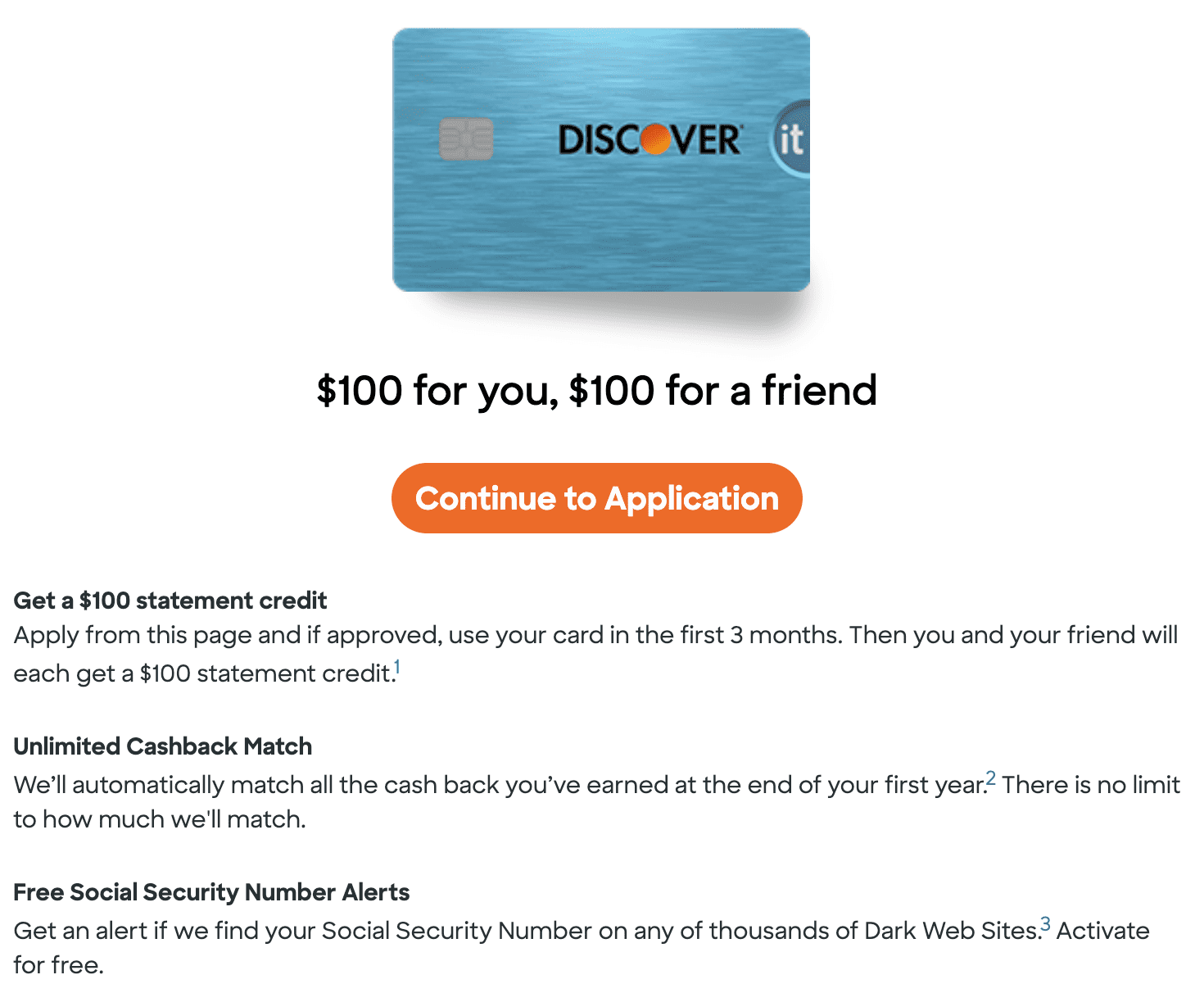

1.2 Current referral bonus of $100 for new card holders

As of March 2024, the Discover credit card referral program offers a generous bonus of $100 for new card holders who apply using a valid referral link. This bonus is credited to the new cardholder’s account after they make their first purchase within the first three months of card membership. The $100 bonus is a significant incentive for students to apply for a Discover credit card, as it can help offset some of their initial expenses or be used to pay down their balance.

It is important to note that the referral bonus is subject to change, and students should verify the current bonus amount before applying. However, the $100 bonus has been a consistent offering from Discover, making it an attractive option for students seeking a rewarding credit card.

In the following sections, we will delve into the specific benefits of the Discover credit card for students, discuss potential changes to the referral program and bonus structure, provide a step-by-step guide to applying for the card, and offer tips on maximizing referral benefits and using credit responsibly as a student.

2. Discover Credit Card Benefits for Students and others

2.1 No annual fee

One of the most appealing aspects of the Discover credit card for students is the absence of an annual fee. Many credit cards, especially those with rewards programs, charge an annual fee that can range from $50 to several hundred dollars. For students who are often on a tight budget, these fees can be a significant burden. However, with the Discover credit card, students can enjoy all the benefits of the card without worrying about an annual fee eating into their funds.

The lack of an annual fee means that students can keep the card open for an extended period, even if they don’t use it frequently, without incurring any additional costs. This can be particularly beneficial for students who are just starting to build their credit history, as the length of their credit history is a factor in determining their credit score.

2.2 Cash back rewards on purchases

Another attractive feature of the Discover credit card for students is the cash back rewards program. The card offers a generous 5% cash back on rotating categories each quarter, up to a quarterly maximum (typically $1,500 in purchases). These categories often include gas stations, restaurants, Amazon.com, or wholesale clubs. For all other purchases, students earn an unlimited 1% cash back.

The cash back rewards can accumulate quickly, especially for students who use their credit card for most of their expenses. These rewards can be redeemed for statement credits, electronic deposits to a bank account, or charitable donations. By earning cash back on their purchases, students can effectively save money on their everyday expenses and potentially offset some of their educational costs.

2.3 Good Grades Reward program

Discover also offers a unique Good Grades Reward program for students who maintain a high GPA. For each school year that a student maintains a GPA of 3.0 or higher (up to five consecutive years), Discover will award a $20 statement credit. This reward not only encourages students to excel academically but also provides a small financial incentive for their hard work.

To be eligible for the Good Grades Reward, students must be enrolled in an accredited college or university and have a Discover credit card in their name. They must submit their GPA information each year to receive the reward. While $20 may seem like a small amount, it can add up over time and serve as a nice bonus for students who consistently perform well in their studies.

2.4 FICO credit score monitoring

Discover also provides free FICO credit score monitoring for its cardholders. This service allows students to keep track of their credit score and receive alerts when there are significant changes. As students are just beginning to establish their credit history, monitoring their credit score can be an invaluable tool in helping them understand the factors that influence their score and make informed decisions about their credit usage.

By regularly checking their credit score, students can identify any potential issues early on and take steps to address them before they become more serious problems. Additionally, seeing their credit score improve over time can be a motivating factor for students to continue practicing responsible credit habits.

In summary, the Discover credit card offers a range of benefits tailored specifically to the needs of students. With no annual fee, cash back rewards on purchases, a Good Grades Reward program, and free FICO credit score monitoring, this card provides a convenient and rewarding way for students to build their credit history and manage their finances responsibly.

3. Potential Changes to the Referral Program and Bonus Structure

3.1 Possible sale of Discover Bank

Recent news in the financial industry has hinted at the potential sale of Discover Bank. While the details of the sale are not yet public, it is essential for current and prospective Discover credit card holders to be aware of this development. A change in ownership could lead to various changes in the bank’s policies, including the referral program and bonus structure.

3.2 Potential impact on the referral system

If Discover Bank is indeed sold, the new owners may choose to modify or even discontinue the current referral program. They could decide to alter the referral bonus amount, change the eligibility requirements, or place new restrictions on how and when the bonus is earned.

4. Step-by-Step Guide to Applying for a Discover Credit Card

4.1 Gathering necessary information

Before beginning the application process for a Discover credit card, students should gather all the necessary information to ensure a smooth and efficient experience. They will need to provide personal details such as their full name, date of birth, Social Security number, and current address. Additionally, students should have information about their income, employment status, and monthly housing payments readily available.

It is important for students to ensure that all the information they provide is accurate and up-to-date, as any discrepancies could lead to delays in processing their application or even result in a denial.

4.2 Accessing the online application form

To apply for a Discover credit card, students should click on the https://refer.discover.com/ Referral Link

4.3 Filling out the application with example responses

When completing the online application form, students should provide accurate and honest information. Here’s a detailed guide on how to fill out the fields shown in the provided screenshot:

- ZIP Code: Enter your 5-digit ZIP code for your current residence. This helps Discover verify your identity and determine eligibility based on your location.

- Last 4 Digits of Social Security Number: Input the last 4 digits of your Social Security Number (SSN). This is a unique identifier that assists in verifying your identity and creditworthiness. If you do not have an SSN, you may need to contact Discover for alternative identification methods.

- Date of Birth (MM/DD/YYYY): Provide your date of birth in the format of Month/Day/Year, using two digits for each section. You must be at least 18 years old to apply for a Discover credit card.

Below the input fields, you’ll find two important notices:

- By clicking “Continue,” you authorize your wireless carrier to disclose your mobile number to Discover and third party service providers to verify your identity and prevent fraud.

- You also authorize Discover and its service providers to obtain your name, address, phone number, and email from third parties to validate your identity and populate the application form.

After carefully reviewing the information you provided and reading the notices, click the “Continue” button to proceed with your application. If you wish to skip this step for now, click “Skip This Step” at the bottom of the form.

Completing the Application with Sample Responses

In this section of the Discover credit card application, you will provide your personal information and agree to the terms and conditions. Here’s a detailed breakdown of how to complete each field:

Card Design

Choose your preferred card design from the available options by clicking on the desired image.

Your Information

- Name: Enter your full legal name, including your first and last name.

- Home Address: Provide your current residential address where you want the card to be mailed.

- Date of Birth (MM/DD/YYYY): Input your date of birth in the format of Month/Day/Year, using two digits for each section.

- Employment Status: Select your current employment status from the dropdown menu (e.g., employed, self-employed, student, retired).

- Monthly Housing/Rent Payment: Enter your monthly housing costs, such as rent or mortgage payments.

- Total Gross Income: Provide your total annual income before taxes and deductions.

- Email Address: Input a valid email address where Discover can contact you regarding your application and account.

Terms & Conditions

Review the Terms and Conditions carefully, including the Text and Call Disclosure, Important Information, and Interest Rates and Interest Charges sections. Key points to note:

- By submitting the application, you agree to allow Discover to contact you via phone, including through automated means, regarding your application and account.

- The Interest Rates and Interest Charges section outlines the APR for Purchases and Balance Transfers, which will be 0% intro APR for 15 months from the date of account opening, followed by a variable APR of 17.24% to 28.24% based on your creditworthiness.

After reviewing the Terms and Conditions, check the box to indicate your agreement.

Once you have completed all the required fields and agreed to the Terms and Conditions, click the “Submit” button to process your application.

4.4 Submitting the application and waiting for approval

After completing the application, you should carefully read and agree to the terms and conditions before clicking the “Submit” button. They may be required to verify their identity by providing additional documentation, such as a copy of their driver’s license or student ID.

Once the application is submitted, Discover will review the information provided and make a decision regarding approval. This process typically takes a few minutes to a few days, depending on the individual circumstances. If approved, students will receive their new Discover credit card in the mail within 7-10 business days.

If the application is denied, Discover will send a letter explaining the reasons for the denial and provide information on how to request a free copy of the credit report used in the decision. Students should review this information carefully and take steps to address any issues that may have led to the denial, such as improving their credit score or correcting any errors on their credit report.

By following this step-by-step guide and providing accurate information, students can streamline the application process for a Discover credit card and take advantage of the current $100 referral bonus offer. In the next section, we will discuss strategies for maximizing referral benefits and making the most of the Discover credit card rewards program.

5. Maximizing Referral Benefits

5.1 Sharing your referral link with friends and family

One of the most effective ways for students to maximize their referral benefits is by sharing their unique referral link with friends and family members. Discover makes it easy for cardholders to access and share their referral link through the online account management platform or mobile app.

To obtain the referral link, students should log in to their Discover account, navigate to the referral section, and copy the provided link. They can then share this link via email, text message, or social media platforms with friends and family members who may be interested in applying for a Discover credit card.

5.2 Encouraging others to apply using your link

When sharing the referral link, students should be sure to highlight the benefits of the Discover credit card, such as the $100 referral bonus, cash back rewards, and lack of annual fees. They should also emphasize that applying through the referral link will not only benefit the new applicant but also help the student earn a referral bonus for themselves.

Students can create a sense of urgency by reminding potential applicants that the $100 referral bonus is a limited-time offer and may change or expire in the future. They should also be available to answer any questions their friends and family may have about the application process or the benefits of the card.

5.3 Tracking your referral bonus progress

To keep track of their referral bonus progress, students should regularly log in to their Discover account and check the referral section. Here, they can view the status of their referrals, including pending and successful applications.

Discover typically awards referral bonuses within 1-2 billing cycles after the referred individual is approved for the credit card and makes their first purchase. Students should keep an eye out for the bonus to appear on their statement and ensure that it is properly credited to their account.

5.4 Using your referral bonus wisely

Once the referral bonus is credited to their account, students should consider using it wisely to maximize its value. Some options include:

- Paying off existing credit card balances: Students can use the referral bonus to pay down any outstanding balances on their Discover card or other credit cards, reducing their overall debt and potentially saving on interest charges.

- Investing in their education: The referral bonus can be used to purchase textbooks, school supplies, or other educational expenses, helping to offset the costs of higher education.

- Building an emergency fund: Students can consider saving the referral bonus in a separate savings account to serve as an emergency fund for unexpected expenses, such as car repairs or medical bills.

- Treating themselves responsibly: If students have been diligently managing their finances and have no outstanding debts, they may choose to use a portion of the referral bonus to treat themselves to a small reward, such as a nice meal or a new piece of technology. However, they should be mindful not to overspend and to use the majority of the bonus in a financially responsible manner.

By actively sharing referral link, encouraging others to apply, tracking their bonus progress, and using their referral bonuses wisely, students can maximize the benefits of the Discover credit card referral program and make the most of this valuable opportunity to earn extra funds while helping their friends and family save money as well.

6. Responsible Credit Card Usage

6.1 Understanding credit limits and interest rates

As students begin their journey with the Discover credit card, it is crucial for them to understand the concepts of credit limits and interest rates. A credit limit is the maximum amount of money that can be charged to the card, and it is determined by the credit card issuer based on factors such as income, credit history, and debt-to-income ratio.

Interest rates, expressed as an Annual Percentage Rate (APR), represent the cost of borrowing money through the credit card. Discover offers competitive APRs for students, but it is essential to remember that interest charges can accumulate quickly if balances are not paid in full each month.

To use their Discover card responsibly, students should aim to keep their balances well below their credit limit and pay their balances in full every month to avoid interest charges.

6.2 Importance of timely payments

One of the most critical aspects of responsible credit card usage is making timely payments each month. Late payments not only result in fees and potential interest charges but can also negatively impact a student’s credit score.

To ensure timely payments, students should set up automatic payments through their Discover online account or mobile app. They can choose to pay the minimum amount due, a fixed amount, or the full balance each month. By setting up automatic payments, students can avoid the risk of forgetting to make a payment and incurring late fees or damage to their credit score.

If a student finds themselves unable to make a payment on time, they should contact Discover as soon as possible to discuss potential options, such as a temporary hardship program or a payment plan.

6.3 Avoiding overspending and debt accumulation

Another key aspect of responsible credit card usage is avoiding overspending and the accumulation of excessive debt. It can be tempting for students to use their credit card for non-essential purchases or to live beyond their means, but doing so can quickly lead to unmanageable debt.

To avoid overspending, students should create a budget that accounts for their income, essential expenses, and discretionary spending. They should use their Discover card only for planned purchases that fit within their budget and can be paid off in full each month.

If a student does find themselves with a growing credit card balance, they should create a plan to pay it off as quickly as possible. This may involve cutting back on discretionary spending, finding additional sources of income, or seeking guidance from a financial advisor or credit counselor.

6.4 Building a positive credit history

By using their Discover credit card responsibly, students can begin building a positive credit history that will serve them well in the future. A strong credit score can make it easier to secure loans, rent apartments, and even find employment in some cases.

To build a positive credit history, students should:

- Make all payments on time

- Keep balances low relative to their credit limit

- Avoid applying for multiple credit cards in a short period

- Monitor their credit report regularly for errors or signs of fraud

By demonstrating responsible credit usage over time, students can establish a solid foundation for their financial future and make the most of the benefits offered by their Discover credit card.

In conclusion, responsible credit card usage is essential for students as they begin building their credit history with the Discover credit card. By understanding credit limits and interest rates, making timely payments, avoiding overspending, and working to build a positive credit history, students can set themselves up for long-term financial success while maximizing the benefits of the Discover referral program.

7. Conclusion

7.1 Recap of the Discover credit card referral program benefits

Throughout this article, we have explored the numerous benefits of the Discover credit card referral program for students. From the generous $100 referral bonus to the cash back rewards, no annual fee, and Good Grades Reward program, the Discover credit card offers a compelling package of incentives designed to appeal to the unique needs and financial situation of students.

In conclusion, the Discover credit card referral program presents a unique opportunity for students to earn valuable bonuses, build their credit, and develop responsible financial habits. By staying informed, adapting to potential changes, and leveraging the step-by-step application guide and referral strategies outlined in this article, students can maximize their benefits and set themselves up for long-term financial success.

FAQ

| Question | Answer |

|---|---|

| What is the Discover Student Credit Card referral bonus? | The current referral bonus for the Discover Student Credit Card is $100 for both the referrer and the referred individual upon approval and first purchase. |

| How can I apply for the Discover Student Credit Card? | You can easily apply for the Discover Student Credit Card online by following our step-by-step guide, which includes gathering necessary information and filling out the application form. |

| What are the benefits of the Discover Student Credit Card? | The Discover Student Credit Card offers various benefits, such as no annual fee, cash back rewards, the Good Grades Reward program, and free FICO credit score monitoring. |

| How can I maximize my referral benefits? | To maximize your referral benefits, share your unique referral link with friends and family, encourage them to apply using your link, track your bonus progress, and use your bonus wisely by paying off balances, investing in education, or building an emergency fund. |

| What should I be aware of regarding the potential sale of Discover Bank? | Stay informed about the potential sale of Discover Bank, as it may lead to changes in the referral program and bonus structure. Regularly check for updates from Discover through their official channels and adapt your strategies accordingly. |

| How can I use my Discover Student Credit Card responsibly? | To use your Discover Student Credit Card responsibly, understand your credit limit and interest rates, make timely payments, avoid overspending, and work on building a positive credit history. |

| What are the long-term benefits of using the Discover Student Credit Card? | By using the Discover Student Credit Card responsibly and taking advantage of its benefits, you can build a strong credit foundation, earn valuable rewards, and set yourself up for long-term financial success. |

Leave a Reply